Earlier this year, Koru was among the stakeholders invited to provide inputs for Vietnam’s upcoming government-backed VC initiatives.

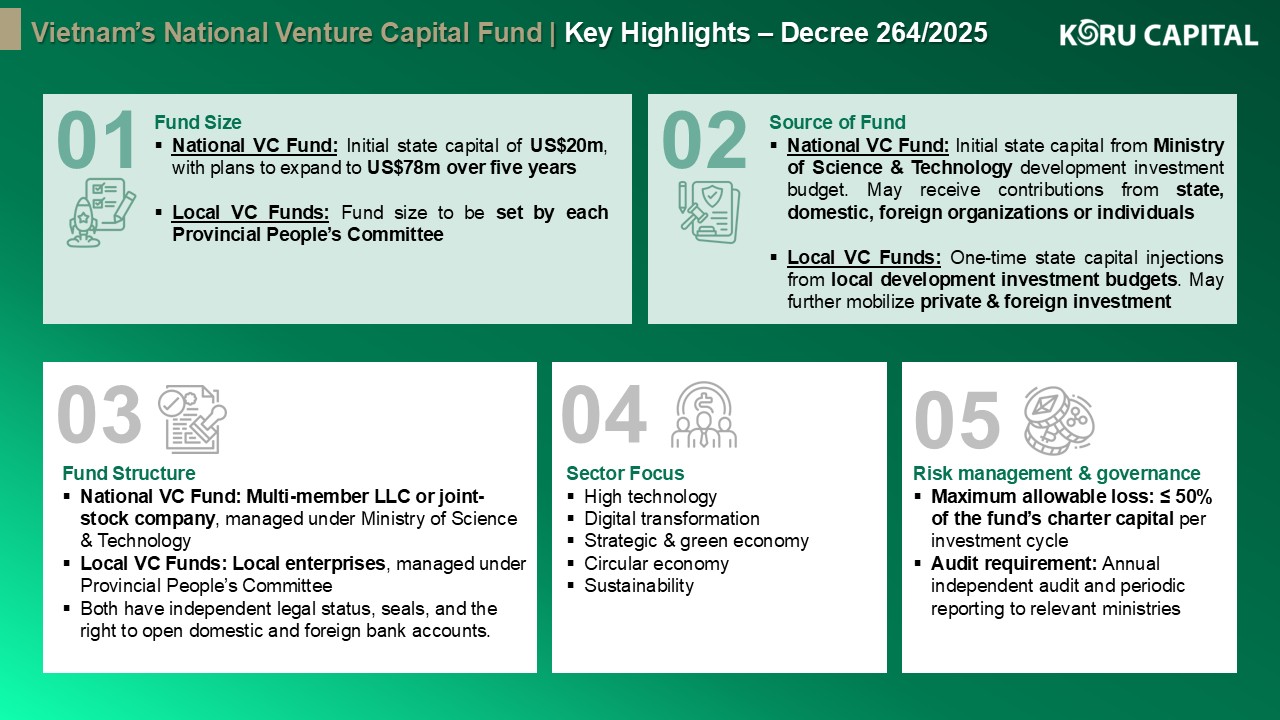

Now, it’s official. Under Decree 264/2025, Vietnam has formally outlined the establishment and operation of the National Venture Capital Fund and local venture capital funds, marking a major step toward deepening state participation in the startup and innovation ecosystem.

💡 Key points:

- Initial state capital of ~US $20 million, with plans to expand to ~US $78 million over five years.

- Mandate: invest in technology, digital transformation, strategic and green technologies, circular economy and sustainability.

- Designed to co-invest with private and institutional investors, encouraging early-stage innovation funding.

🔍 What to watch next:

- How the fund will be managed and deployed

- The sectors prioritized in its first allocations

- The extent of foreign or private co-investor participation

- Will the fund be able to take a longer investment horizon and lower return for the greater good, compared to the private funds.

This fund represents more than just capital — it’s a statement of intent. Vietnam is signaling its ambition to evolve from a manufacturing-led growth model to one driven by innovation and technology.

At Koru, we’re proud to have contributed our perspective during the formation process — and we’ll continue tracking how this initiative reshapes Vietnam’s investment landscape.