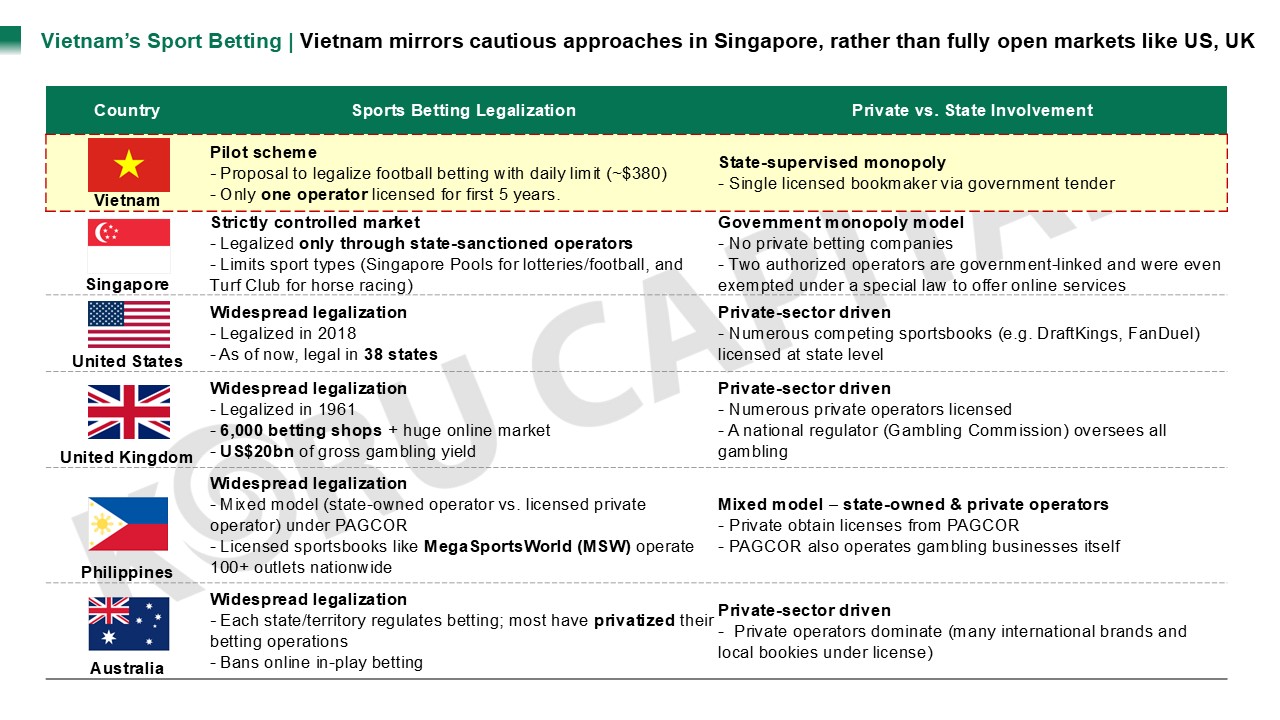

Vietnam is gradually opening markets that were once illicit—but under strict controls. The latest example: a draft proposal to legalize international football betting with a daily cap of ₫10 million (~$380), up from the current ₫1 million per category.

📌 Key points:

The reform will run as a five-year pilot, with only one licensed operator chosen by the state.

The goal is to channel underground gambling into regulated systems—mirroring the rollout of Vietlott in 2016 (via partnership with Berjaya Corp).

Benefits: curb illegal betting, boost tax revenues, and provide safer outlets for demand.

🌏 How does this compare globally?

- Singapore: Highly restricted, state-monopoly models to combat illegal rings.

- US & UK: Liberalized markets, multiple private operators, and billions in tax revenue.

- Philippines & Australia: More open frameworks, diverse operators, and significant contribution to national budgets.

By comparison, Vietnam’s model is cautious, pragmatic, and state-supervised—less about innovation, more about catching up. It’s a familiar path: tightly controlled legalization to siphon activity away from the black market.

👀 Call to Watch:

For investors in fintech, gaming, and entertainment, this pilot signals a potentially investable frontier.

This is such an exciting time for the Vietnam market. We can’t keep up with all the relentless initiatives being introduced.